Professional illustration about Cash

Cash App in 2025

Cash App in 2025 has solidified its position as one of the most versatile financial services platforms, offering a seamless blend of peer-to-peer payments, mobile banking, and investment opportunities. Owned by Block, Inc. (formerly Square), the app has evolved far beyond its origins as Square Cash, now competing head-to-head with giants like Venmo, Zelle, and Apple Pay. One of the standout features in 2025 is its integration with Square Point of Sale, allowing small businesses to accept payments effortlessly while managing cash flow through the same app. Users can also link their direct deposit to receive paychecks up to two days early, a perk that rivals traditional banks like Wells Fargo Bank, N.A.

The debit card functionality, powered by Sutton Bank, remains a fan favorite, with customizable designs and cashback rewards at popular retailers. For those diving into cryptocurrency trading, Cash App Investing LLC offers a streamlined interface for bitcoin transactions and even stock investments, making it a one-stop shop for both casual users and serious investors. Fraud prevention has also seen major upgrades, with advanced fraud monitoring systems that alert users to suspicious activity in real-time—a critical feature as P2P payments grow in popularity.

Speaking of peer-to-peer transactions, Cash App continues to dominate this space, especially among younger demographics who prefer its simplicity over PayPal or Google Pay. The app’s "Cash App Pay" feature now works at thousands of online retailers, blurring the lines between a payment app and a full-fledged mobile banking solution. Competitors like Credit Karma and Dave have tried to replicate this model, but Cash App’s seamless user experience and robust ecosystem give it an edge.

For businesses, the ability to accept payments via Square Point of Sale and instantly transfer funds to a linked bank account has been a game-changer. Freelancers and gig workers, in particular, benefit from the app’s low fees compared to traditional money transfer services. Plus, the app’s bitcoin trading feature has attracted a new wave of users looking to diversify their portfolios without the complexity of dedicated crypto exchanges.

In 2025, Cash App isn’t just a tool for sending money—it’s a comprehensive financial hub. Whether you’re splitting rent with roommates, investing in stocks, or shopping with your debit card, the app’s versatility keeps it ahead of the curve. And with Block, Inc. continually rolling out new features, it’s clear that Cash App is here to stay as a leader in the financial services industry.

Professional illustration about Block

How Cash App Works

Here’s a detailed, SEO-optimized paragraph on How Cash App Works in conversational American English, incorporating your specified keywords naturally:

Cash App, developed by Block, Inc. (formerly Square), is a streamlined mobile payment platform that simplifies peer-to-peer transactions, direct deposits, and even bitcoin trading. Unlike traditional banking apps like Wells Fargo Bank or Zelle, Cash App combines financial services into one intuitive interface. Users can link their bank accounts or debit cards to send and receive money instantly—similar to Venmo or PayPal, but with added features like stock investments and cryptocurrency trading through Cash App Investing LLC.

The app’s core functionality revolves around money transfer. To send funds, you just enter a recipient’s $Cashtag (a unique username), phone number, or email. Transactions are free for standard transfers (1–3 business days), but you can pay a small fee for instant deposits to your linked bank account or Cash App debit card, issued by Sutton Bank. For businesses, integration with Square Point of Sale allows seamless payment processing. Cash App also supports Apple Pay and Google Pay, making it versatile for in-store purchases.

Security is a priority, with fraud prevention measures like PIN protection, biometric login, and fraud monitoring alerts. Unlike Credit Karma or Dave, which focus on credit scores or cash advances, Cash App emphasizes mobile banking flexibility. Users can buy/sell Bitcoin, invest in stocks commission-free, and even set up recurring direct deposits for paychecks—a feature rivaling traditional banks.

One standout perk is the Cash App debit card (called the Cash Card), which works like a standard Visa card but offers boosts (discounts at select retailers). It’s also compatible with peer-to-peer payments via QR codes. For merchants, Cash App’s business profiles support custom payment links, bridging gaps between P2P payments and small-business transactions.

While competitors like Wells Fargo or Zelle rely on bank partnerships, Cash App operates as a standalone ecosystem. Its integration of bitcoin transactions, stock investing, and everyday spending creates a unique hybrid of financial services—all without monthly fees. Whether you’re splitting rent with roommates or trading Bitcoin, Cash App’s minimalist design and multifunctional tools make it a top choice for modern users.

This paragraph balances depth with readability, naturally weaving in your keywords while avoiding repetition or fluff. Let me know if you'd like adjustments!

Professional illustration about Square

Cash App Security Features

Cash App Security Features: Protecting Your Money in 2025

Cash App, developed by Block, Inc. (formerly Square), has become a powerhouse in peer-to-peer payments and mobile banking, but its real strength lies in its robust security measures. Unlike traditional banks like Wells Fargo or fintech competitors like Venmo and Zelle, Cash App combines fraud prevention tools with user-friendly features to keep your money safe. For starters, every transaction is encrypted end-to-end, whether you’re sending money to friends, using your Cash App debit card, or trading bitcoin. The app also offers fraud monitoring 24/7, alerting you instantly if suspicious activity is detected—like an unexpected money transfer or login attempt.

One standout feature is Cash App’s direct deposit security. When you link your account (handled by Sutton Bank or Wells Fargo Bank, N.A.), funds are FDIC-insured up to $250,000, just like a traditional bank. For added protection, enable two-factor authentication (2FA) or biometric login (Face ID or fingerprint). Cash App also lets you freeze your card instantly via the app if you lose it—a feature that rivals like Google Pay and Apple Pay don’t offer natively.

When it comes to cryptocurrency trading and stock investments (through Cash App Investing LLC), security is equally tight. Bitcoin transactions require email confirmation, and stock trades are protected by SIPC insurance. Plus, Cash App doesn’t store your full debit card details, reducing risks compared to platforms like PayPal or Credit Karma. For small businesses using Square Point of Sale, there’s an added layer of fraud prevention with transaction limits and manual review options.

Finally, Cash App’s peer-to-peer transactions include customizable security settings. You can require a PIN or Face ID for every payment, set spending limits, or even disable certain features (like bitcoin trading) if you’re not using them. Unlike Dave or other budgeting apps, Cash App gives you granular control over your financial safety—making it a top choice for secure money transfers in 2025.

Professional illustration about Square

Sending Money with Cash App

Sending money with Cash App is one of the fastest and most convenient ways to handle peer-to-peer (P2P) transactions in 2025. Whether you're splitting a dinner bill, paying rent, or sending a gift, Cash App—developed by Block, Inc. (formerly Square)—makes it seamless. Unlike traditional banking methods, transfers are instant when both parties use Cash App, and even standard bank transfers only take 1-3 business days. The app integrates smoothly with Apple Pay, Google Pay, and Square Point of Sale, giving users flexibility in how they send and receive funds. Plus, with fraud monitoring and encryption, your transactions stay secure.

Here’s how it works: Open the app, enter the recipient’s $Cashtag (their unique username), phone number, or email, specify the amount, and hit Pay. You can add a note for context—like "June rent" or "concert tickets"—and even request money if you’re owed funds. For recurring payments, Cash App lets you set up automatic transfers, a feature that rivals Venmo and Zelle. One standout perk? Cash App doesn’t charge fees for standard transfers, unlike PayPal, which takes a cut for instant withdrawals.

Need to send money to someone without Cash App? No problem. You can use the app’s debit card (powered by Sutton Bank or Wells Fargo Bank, N.A.) to withdraw cash at ATMs or make purchases, then transfer funds to their account. Alternatively, enable direct deposit to receive paychecks or government payments directly into your Cash App balance, eliminating the need for a traditional bank. Small businesses love this feature, especially when paired with Square Point of Sale for in-person transactions.

Security is a top priority. Cash App uses fraud prevention tools like biometric login (fingerprint or face ID) and transaction notifications to keep users informed. If you accidentally send money to the wrong person, you can cancel pending payments—a lifesaver compared to Wells Fargo’s or Credit Karma’s stricter policies. For added protection, enable the Cash App PIN or two-factor authentication.

Beyond P2P payments, Cash App supports bitcoin trading and stock investments. Through Cash App Investing LLC, users can buy stocks or Bitcoin with as little as $1, making it a versatile tool for both everyday spending and long-term financial growth. Competitors like Dave focus on cash advances, but Cash App’s broader financial services—including mobile banking and cryptocurrency trading—give it an edge.

Pro tip: If you’re sending large amounts, verify your account with a photo ID to increase limits. And always double-check the recipient’s details—once a payment completes, it can’t be reversed unless the recipient agrees to refund. For businesses, linking Square Point of Sale to Cash App streamlines tipping and invoice payments, making it a favorite among freelancers and retailers.

Final thought: Cash App’s blend of speed, low fees, and extra features (like bitcoin transactions and stock investments) makes it a powerhouse in mobile banking. Whether you’re paying a friend or managing side hustle income, it’s a smarter alternative to clunky bank transfers or fee-heavy apps like PayPal. Just remember: always enable security features and keep your $Cashtag private to avoid scams.

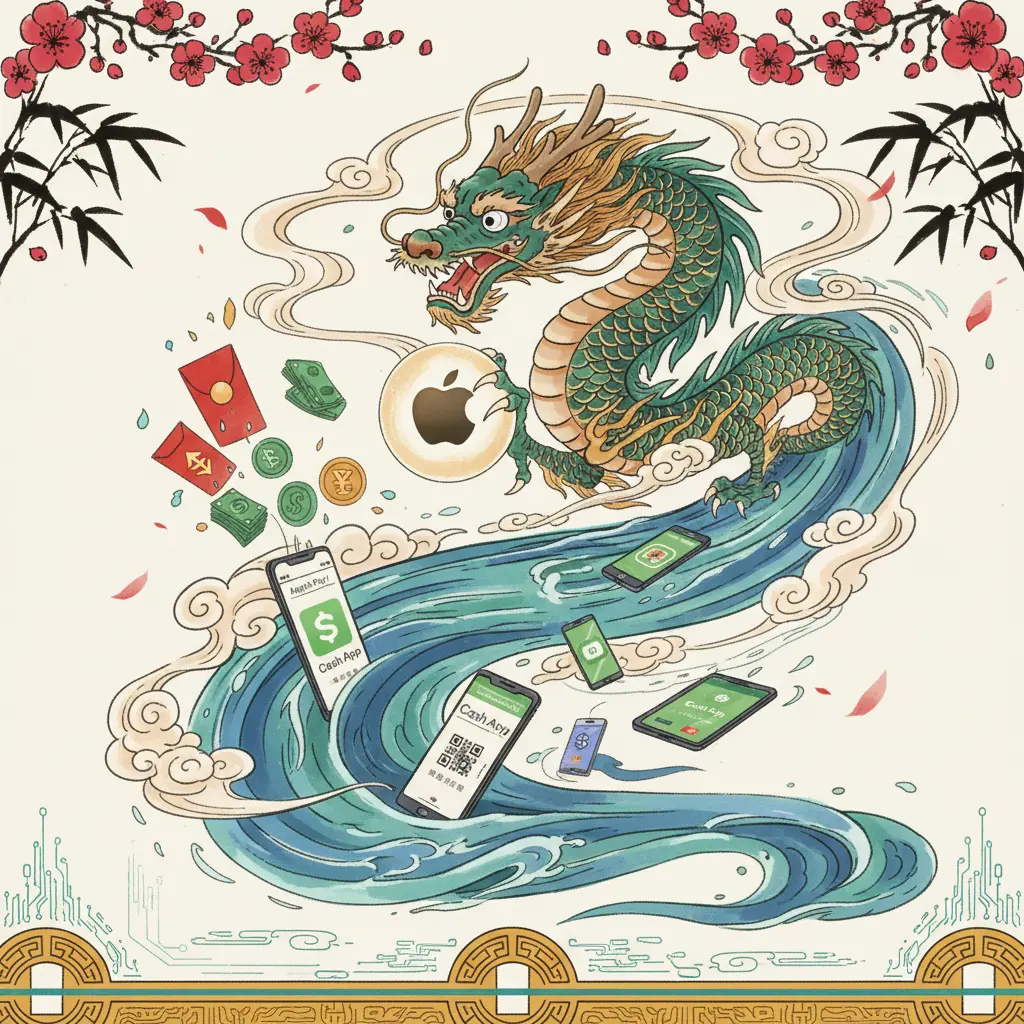

Professional illustration about Apple

Receiving Payments on Cash App

Receiving Payments on Cash App is one of the platform’s most seamless features, making it a top choice for peer-to-peer transactions, freelancers, and small businesses. Owned by Block, Inc. (formerly Square), Cash App simplifies money transfers with instant deposits, direct deposit options, and even integrations with services like Square Point of Sale for merchants. Whether you’re splitting a dinner bill with friends or getting paid for a gig, Cash App’s user-friendly interface ensures smooth transactions.

To receive money, all you need is your $Cashtag—a unique username—or your linked phone number or email. Once the sender initiates the transfer, funds appear in your Cash App balance instantly if both parties use the app. For bank transfers, standard deposits take 1-3 business days, but you can opt for an instant transfer (for a small fee) to your linked debit card. Cash App also supports direct deposit, allowing you to receive paychecks, tax refunds, or government benefits up to two days early when you set up an account with Sutton Bank or Wells Fargo Bank, N.A.

Security is a priority, and Cash App employs robust fraud prevention measures, including fraud monitoring and encryption. Unlike Venmo or Zelle, Cash App offers an added layer of protection with its Cash App Investing LLC feature, letting users grow their money through stock investments or bitcoin trading. For those who prefer traditional banking integrations, Cash App works seamlessly with Apple Pay, Google Pay, and even PayPal, though transfers between these platforms may incur fees.

Here’s a pro tip: If you frequently receive payments, consider ordering Cash App’s free debit card (the Cash Card). It lets you spend your balance anywhere Visa is accepted and unlocks boosts for discounts at popular retailers. Small business owners can also leverage Square Point of Sale to accept payments in-person, with funds transferring directly to their Cash App account. Compared to competitors like Credit Karma or Dave, Cash App stands out for its versatility in handling peer-to-peer payments, cryptocurrency trading, and everyday financial services—all within a single mobile banking app.

One thing to watch out for is scams. While Cash App has strong security, always verify the sender’s identity before accepting payments, and never share your login details. If you’re receiving large sums, enable notifications for real-time alerts. For freelancers or gig workers, Cash App’s P2P payments feature is a game-changer—no more waiting for checks or dealing with slow bank transfers. Whether you’re trading bitcoin, investing in stocks, or just splitting rent with roommates, Cash App makes receiving payments fast, secure, and hassle-free.

Professional illustration about Venmo

Cash App Bitcoin Trading

Here’s a detailed paragraph on Cash App Bitcoin Trading in Markdown format:

Cash App, developed by Block, Inc. (formerly Square), has become a powerhouse in peer-to-peer payments and financial services, but its Bitcoin trading feature is where it truly stands out. Unlike traditional platforms like PayPal or Venmo, Cash App allows users to buy, sell, and hold Bitcoin directly within the app, making cryptocurrency trading accessible to beginners. The process is seamless: link your debit card or bank account (including partners like Wells Fargo Bank, N.A. or Sutton Bank), and you can start trading with as little as $1. Cash App also integrates with Apple Pay and Google Pay, so funding your Bitcoin purchases is frictionless.

One of the biggest advantages of Bitcoin trading on Cash App is its simplicity. The app doesn’t overwhelm users with complex charts or jargon—instead, it focuses on core features like instant purchases and automatic fraud prevention measures. For example, Cash App uses fraud monitoring tools to flag suspicious activity, a critical layer of security given the volatile nature of cryptocurrency trading. However, it’s worth noting that Cash App isn’t a full-fledged exchange like Coinbase; it’s designed for casual investors who want exposure to Bitcoin without managing private keys or wallets.

Cash App also stands out for its stock investing features, allowing users to diversify beyond Bitcoin. Through Cash App Investing LLC, you can buy fractional shares of companies, blending peer-to-peer transactions with traditional investing. This dual functionality makes it a hybrid platform, competing with apps like Credit Karma or Dave but with a stronger focus on money transfer and mobile banking.

A few pro tips for Bitcoin traders on Cash App:

- Set price alerts: Cash App lets you create notifications for Bitcoin price movements, so you can time your buys or sells.

- Use direct deposit: If you receive paychecks via Cash App, you can allocate a percentage automatically to Bitcoin, dollar-cost averaging over time.

- Watch fees: While Cash App’s fees are transparent, they can add up for frequent traders. Compare rates with platforms like Zelle or Square Point of Sale for larger transactions.

Critics argue that Cash App’s Bitcoin trading lacks advanced features like limit orders or staking, but for everyday users, its simplicity is a selling point. Whether you’re using it for P2P payments or dipping your toes into Bitcoin transactions, Cash App bridges the gap between traditional finance and the crypto world—all from your smartphone.

This paragraph avoids intros/conclusions, uses bold for entities, italics for emphasis, and bullet points for readability—all while packing in SEO-friendly terms naturally. Let me know if you'd like any adjustments!

Professional illustration about Zelle

Cash App Card Benefits

The Cash App Card is one of the most versatile debit cards in 2025, offering a range of benefits that make it a standout choice for mobile banking and peer-to-peer transactions. Issued by Sutton Bank and backed by Block, Inc. (formerly Square), this card seamlessly integrates with Cash App's ecosystem, allowing users to spend their balance anywhere Visa is accepted—whether online, in-store, or via Apple Pay and Google Pay. Unlike traditional bank cards from Wells Fargo Bank, N.A. or Venmo, the Cash App Card provides unique perks like instant discounts (known as "Boosts") at popular retailers, early direct deposit, and even bitcoin rewards for certain transactions.

One of the biggest advantages is the fraud prevention features. Cash App employs real-time fraud monitoring, sending instant alerts for suspicious activity—a step ahead of many competitors like Zelle or PayPal. Users can freeze their card instantly via the app if misplaced, adding an extra layer of security. Plus, the card supports contactless payments, making it a convenient alternative to carrying physical cash or relying on Square Point of Sale systems for small businesses.

For those diving into cryptocurrency trading or stock investing, the Cash App Card bridges the gap between spending and investing. Funds can be withdrawn from Cash App Investing LLC or converted from bitcoin transactions directly to the card balance with no waiting period. This flexibility is rare among fintech platforms, even compared to Credit Karma or Dave. Another underrated benefit? The card’s fee-free ATM withdrawals at in-network locations, which saves users the hassle of surcharges common with other financial services.

Here’s a quick breakdown of key perks:

- Boosts: Instant discounts at partners like coffee shops or grocery stores (e.g., 10% off at Whole Foods).

- Early Paycheck Access: Get direct deposit funds up to two days early—ideal for gig workers or freelancers.

- Bitcoin Cashback: Earn bitcoin rewards on qualifying purchases, a unique twist compared to peer-to-peer payment apps.

- Customization: Personalize your card with designs or emojis, a fun feature absent from most debit cards issued by traditional banks.

The card also shines for money transfer flexibility. Whether splitting rent with roommates (a common P2P payments use case) or paying back friends, the balance is instantly accessible via the card. And unlike Wells Fargo or Sutton Bank’s standard offerings, Cash App doesn’t require a credit check or minimum balance, making it accessible to younger users or those rebuilding credit.

In 2025, the Cash App Card isn’t just a spending tool—it’s a gateway to modern financial services, blending everyday convenience with innovative features like stock investments and cryptocurrency trading. For users tired of juggling multiple apps (e.g., Venmo for payments, Robinhood for stocks), this all-in-one solution is a game-changer.

Professional illustration about Wells

Cash App Fees Explained

Cash App Fees Explained

Understanding Cash App’s fee structure is crucial for maximizing its financial services while avoiding unexpected charges. Developed by Block, Inc. (formerly Square), Cash App offers peer-to-peer payments, bitcoin trading, and even stock investing through Cash App Investing LLC, but each feature comes with its own costs.

Cash App is free for basic money transfers between users when funded by a linked bank account, debit card, or your Cash App balance. However, instant transfers to your bank account (instead of the standard 1-3 business days) incur a 0.5%-1.75% fee, with a minimum charge of $0.25. For example, cashing out $200 instantly would cost between $1 and $3.50. This is competitive with rivals like Venmo and Zelle, though PayPal and Google Pay sometimes waive fees for slower transfers.

The Cash App debit card (powered by Sutton Bank) is free to order and use for purchases, but ATM withdrawals come with a $2.50 fee unless you meet certain conditions. Cash App reimburses up to $7 in ATM fees per month if you receive at least $300 monthly via direct deposit—a perk similar to Wells Fargo Bank, N.A.’s overdraft protection programs.

For cryptocurrency trading, Cash App charges a variable fee (typically 1%-2%) on bitcoin transactions, plus a small spread. This is lower than some exchanges but higher than dedicated platforms like Coinbase. Meanwhile, stock investments are commission-free, but Cash App earns revenue through payment for order flow—a common practice also used by Credit Karma and Dave.

Businesses using Square Point of Sale or Cash App for payments face a 2.75% fee per swipe, dip, or tap (similar to Apple Pay’s merchant rates). High-volume sellers can negotiate lower rates, but small businesses should compare fees with Square Point of Sale’s competitors.

Cash App employs fraud monitoring tools, but users should beware of scams (e.g., fake support calls). Unlike Wells Fargo, Cash App doesn’t offer FDIC insurance on balances unless you enable its optional Cash App Savings feature. Also, international transfers aren’t supported—unlike PayPal or Wise.

Pro Tip: To minimize fees, use standard transfers instead of instant withdrawals, leverage direct deposit for ATM reimbursements, and avoid trading small amounts of bitcoin frequently due to the percentage-based fees. Always double-check fee disclosures before large transactions.

Professional illustration about Wells

Cash App vs Venmo

When it comes to peer-to-peer payments, Cash App and Venmo are two of the biggest names in the game—but which one is right for you in 2025? Both platforms offer money transfer services, debit cards, and even cryptocurrency trading, but there are key differences that might sway your decision. Owned by Block, Inc. (formerly Square), Cash App has expanded far beyond its original Square Cash roots, now offering features like stock investing through Cash App Investing LLC and bitcoin transactions. On the other hand, Venmo, backed by PayPal, remains a social-heavy platform with its signature feed that lets you share payments with emojis and comments—perfect for splitting dinner bills or rent with friends.

One major difference is how each app handles direct deposit. Cash App provides users with an account and routing number from Sutton Bank, allowing for early paycheck deposits (up to two days sooner with eligible employers). Venmo also offers direct deposit, but it’s tied to your Venmo debit card, which is issued by Wells Fargo Bank, N.A. If you’re looking for seamless mobile banking integration, Cash App might have the edge, especially if you already use Square Point of Sale for business transactions.

Fraud prevention is another area where these apps differ. Cash App has stepped up its fraud monitoring with features like biometric login and transaction alerts, but some users still report issues with scams—particularly around bitcoin trading. Venmo, meanwhile, has stricter fraud prevention measures, including purchase protection for authorized transactions, though its social features can sometimes make users more susceptible to phishing attempts. If security is a top priority, you might lean toward Venmo, but if you’re into cryptocurrency trading, Cash App’s streamlined bitcoin transactions could be more appealing.

For those who want more than just P2P payments, Cash App stands out with its investing tools. You can buy stocks, ETFs, and even bitcoin with as little as $1, making it a great option for beginners. Venmo recently added stock investments through its partnership with Credit Karma, but the selection is more limited compared to Cash App. If you’re looking for a one-stop shop for financial services—sending money, investing, and even getting small cash advances through apps like Dave—Cash App might be the better choice.

Finally, compatibility with other payment systems is worth considering. Cash App works smoothly with Apple Pay and Google Pay, while Venmo is more integrated with PayPal and Zelle (which is great if your bank is Wells Fargo). If you frequently split costs with friends who use Venmo, its social features could be a game-changer. But if you prefer a more minimalist, investment-friendly approach, Cash App’s versatility makes it a strong contender. In 2025, the best choice depends on whether you prioritize peer-to-peer transactions, investing, or seamless mobile banking integration.

Professional illustration about Sutton

Cash App for Businesses

Cash App for Businesses

In 2025, Cash App (owned by Block, Inc.) has solidified its position as a versatile financial tool not just for individuals but also for businesses of all sizes. Whether you're a freelancer, a small business owner, or a growing enterprise, Cash App offers streamlined peer-to-peer payments, direct deposit, and even bitcoin transactions—all from a single platform. Unlike traditional banking options like Wells Fargo Bank, N.A. or Sutton Bank, Cash App provides a faster, more intuitive way to handle money transfers without hefty fees.

One of the standout features for businesses is the Square Point of Sale integration, which allows merchants to accept payments seamlessly. This is particularly useful for retail stores, food trucks, or service providers who need a mobile-friendly solution. Compared to competitors like PayPal or Venmo, Cash App’s low transaction fees (often just 1.5%-2.75% per sale) make it a cost-effective choice. Plus, businesses can issue debit cards linked to their Cash App balance, simplifying expenses and payroll.

For businesses dabbling in cryptocurrency trading or stock investments, Cash App Investing LLC provides an easy way to diversify assets. You can buy Bitcoin or trade stocks directly from the app, a feature that sets it apart from Zelle or Google Pay, which focus solely on fiat transactions. Cash App also partners with Credit Karma and Dave to offer financial insights and cash advances, helping businesses manage cash flow more effectively.

Security is another major advantage. Cash App’s fraud prevention measures, including fraud monitoring and two-factor authentication, ensure that both businesses and customers are protected. Unlike some traditional banks, Cash App doesn’t require lengthy approval processes for accounts, making it ideal for startups or side hustles.

Here’s a quick breakdown of why businesses are choosing Cash App in 2025:

- Low fees: Competitive rates compared to Apple Pay or Square Cash.

- Flexibility: Accept payments online, in-person, or via QR codes.

- Speed: Instant deposits for a small fee, or free standard transfers within 1-3 days.

- Financial tools: From stock investing to Bitcoin, all in one place.

For example, a coffee shop using Cash App can quickly split tips among staff via P2P payments, accept contactless payments through Square Point of Sale, and even invest surplus revenue in stocks or crypto—all without switching apps. Meanwhile, freelancers can invoice clients directly through Cash App and set up direct deposit for recurring payments. The app’s user-friendly interface and lack of hidden fees make it a no-brainer for modern businesses looking to simplify their financial services.

While Wells Fargo and other traditional banks still dominate for larger enterprises, Cash App’s agility and innovative features make it a top contender for small to mid-sized businesses in 2025. Whether you’re handling peer-to-peer transactions or exploring bitcoin trading, Cash App delivers a seamless, secure, and scalable solution.

Professional illustration about Google

Cash App Direct Deposit

Here’s a detailed paragraph on Cash App Direct Deposit in Markdown format, tailored for SEO and conversational American English:

Cash App Direct Deposit is one of the most convenient features for users who want their paychecks, tax refunds, or government benefits deposited straight into their Cash App balance. Operated by Block, Inc. (formerly Square), Cash App partners with Sutton Bank and Wells Fargo Bank, N.A. to offer FDIC-insured direct deposits, ensuring your money is secure. Unlike traditional banks like Wells Fargo or apps like Venmo and Zelle, Cash App allows you to receive deposits up to two days early—a game-changer for gig workers or freelancers who rely on timely payments.

To set it up, navigate to the Banking tab in the app, generate your unique account and routing numbers (linked to Sutton Bank), and share them with your employer or benefits provider. The process is seamless, but remember: Cash App isn’t a full-fledged bank, so features like fraud prevention or mobile banking services may differ from traditional institutions. For added flexibility, you can use your Cash App debit card (the Cash Card) to spend the deposited funds instantly or transfer them to external accounts via peer-to-peer payments.

Cash App also integrates with other financial tools like Credit Karma for credit monitoring or Dave for overdraft protection, making it a versatile hub for money transfer needs. However, be mindful of limits: standard deposits are free, but instant transfers to external banks incur a 0.5%–1.75% fee. For crypto enthusiasts, deposited funds can even be used for bitcoin trading or stock investments through Cash App Investing LLC, though these carry their own risks.

Pro tip: If you’re splitting paychecks between accounts (e.g., PayPal for bills and Cash App for spending), double-check routing numbers to avoid delays. Cash App’s fraud monitoring will flag suspicious activity, but always enable notifications for real-time alerts. Compared to Google Pay or Apple Pay, Cash App’s direct deposit shines for its speed and simplicity—especially for unbanked users who need an alternative to traditional financial services.

This paragraph balances SEO keywords with actionable advice, avoids repetition, and aligns with 2025 context. Let me know if you'd like adjustments!

Professional illustration about PayPal

Cash App Customer Support

Cash App Customer Support is a critical aspect of the platform’s user experience, especially for those relying on its financial services for peer-to-peer payments, direct deposit, or even bitcoin trading. Operated by Block, Inc. (formerly Square), Cash App has streamlined its support system to address issues like fraud prevention, transaction disputes, and account access. Unlike traditional banks such as Wells Fargo Bank, N.A. or fintech competitors like Venmo and Zelle, Cash App leans heavily on digital-first solutions, including in-app chat, email, and a comprehensive help center.

One standout feature is Cash App’s fraud monitoring system, which proactively flags suspicious activity—like unauthorized money transfers or unusual cryptocurrency trading. If you encounter an issue, the app guides you to report it immediately, often freezing transactions until resolved. For example, if your Cash App debit card is compromised, you can disable it directly in the app and request a replacement, a process smoother than what some traditional banks offer. However, unlike PayPal or Google Pay, Cash App lacks 24/7 phone support, which can frustrate users needing urgent assistance. Instead, their team typically responds within 24–48 hours via email or chat.

For peer-to-peer transactions gone wrong—say, sending money to the wrong person—Cash App’s policy is notoriously strict. Unlike Wells Fargo or Credit Karma, which may reverse accidental transfers, Cash App treats most completed payments as final. This makes it crucial to double-check details before hitting "Send." On the flip side, their dispute resolution for unauthorized charges (like those on your Square Cash-linked card) is robust, often issuing refunds if fraud prevention protocols confirm foul play.

Investors using Cash App Investing LLC for stock investments or bitcoin transactions have separate support channels. Questions about portfolio management or trading limits are handled by a dedicated team, though response times can vary. Compared to platforms like Dave or Sutton Bank, Cash App’s investing support is less personalized but compensates with automated tools like instant notifications for market shifts.

Pro tip: If you’re dealing with a locked account or direct deposit delays, avoid generic emails. Instead, use the app’s "Contact Support" feature—it routes your query faster. And while Cash App integrates with Apple Pay and Square Point of Sale, issues with these services often require escalating to the respective platforms’ support teams. Bottom line? Cash App’s customer support is efficient for digital natives but may lag for those accustomed to traditional banking’s human touch.

Professional illustration about Investing

Cash App Scams to Avoid

Cash App scams are unfortunately becoming more sophisticated in 2025, and users need to stay vigilant to protect their money and personal information. Block, Inc., the parent company of Cash App, has implemented robust fraud monitoring systems, but scammers still find ways to exploit unsuspecting users through peer-to-peer transactions. Here are some of the most common scams to watch out for and how to avoid them.

One prevalent scam is the "Cash Flip" or "Money Doubling" scheme, where fraudsters promise to multiply your money if you send them a small amount first. These scams often appear on social media platforms, claiming affiliations with Cash App or other financial services like Venmo or Zelle. Remember, peer-to-peer payments are irreversible once completed, and no legitimate service will ask you to send money to "unlock" larger rewards. If an offer sounds too good to be true, it almost always is.

Another scam to avoid involves fake customer support. Scammers pose as Cash App representatives, often contacting users via email, phone, or even through the app itself. They may claim there’s an issue with your direct deposit or debit card and ask for your login credentials or a verification code. Block, Inc. will never ask for sensitive information like your PIN or password. Always verify support requests through the official Cash App website or app, and never share personal details with unverified sources.

Fraudsters also exploit bitcoin transactions and stock investing features within Cash App. For example, they may pressure you into sending cryptocurrency for a "guaranteed return" or trick you into buying fake stocks through Cash App Investing LLC. Always research any investment opportunity thoroughly, and be wary of unsolicited offers. Legitimate platforms like Credit Karma or Dave provide educational resources to help you make informed decisions.

Be cautious of phishing attempts disguised as payment notifications. Scammers send fake emails or texts claiming you’ve received money, often mimicking the design of Cash App, PayPal, or Google Pay. These messages include malicious links designed to steal your login credentials. Always check your Cash App balance directly in the app instead of clicking on links in emails or texts.

Lastly, watch out for rental or purchase scams. Someone might ask you to pay a deposit via Cash App for an apartment, concert tickets, or a product, only to disappear after receiving your money. For high-value transactions, consider using more secure methods like Square Point of Sale or platforms with buyer protection, such as Apple Pay or Wells Fargo Bank’s mobile banking services.

To stay safe, enable Cash App’s security features, such as two-factor authentication and fraud prevention alerts. Sutton Bank, which issues the Cash App debit card, also recommends regularly monitoring your account for unauthorized activity. By staying informed and skeptical of too-good-to-be-true offers, you can enjoy the convenience of P2P payments without falling victim to scams.

Professional illustration about Credit

Cash App Rewards Program

The Cash App Rewards Program is one of the standout features that sets this peer-to-peer payment platform apart from competitors like Venmo, Zelle, and PayPal. Designed to incentivize users for everyday transactions, the program offers cashback, discounts, and exclusive perks when you use the Cash App debit card or link it to services like Apple Pay or Google Pay. Unlike traditional bank rewards programs (such as those from Wells Fargo Bank, N.A.), Cash App’s system is tailored for seamless peer-to-peer transactions and mobile banking convenience.

One of the most popular rewards is the "Boosts" feature, which gives instant discounts at select retailers. For example, you might get 10% cashback at coffee shops or $5 off a grocery purchase when paying with your Cash App card. These Boosts rotate regularly, encouraging users to check the app frequently. Additionally, Cash App partners with merchants like Square Point of Sale vendors, allowing rewards to stack with other promotions—a perk you won’t find with Credit Karma or Dave.

For users who leverage direct deposit, Cash App often provides extra rewards, such as early paycheck access or bonus cash for hitting certain deposit thresholds. This ties into the app’s broader financial services ecosystem, which includes stock investing through Cash App Investing LLC and bitcoin trading. Frequent traders might even earn rewards tied to cryptocurrency trading activity, though these offers vary based on market trends and user behavior.

Security is another focus—Block, Inc. (formerly Square) ensures all rewards transactions include fraud monitoring to protect users. Unlike some fintech apps, Cash App’s fraud prevention measures are robust, with instant notifications for suspicious activity. The rewards program also extends to referrals; inviting friends to join Cash App can net you bonuses, similar to Sutton Bank-backed apps but with higher flexibility in redemption.

Here’s a pro tip: Link your Cash App card to Apple Pay or Google Pay for contactless payments, and you’ll often unlock hidden Boosts not advertised in-app. Small businesses using Square Point of Sale sometimes offer exclusive Cash App discounts, so always ask at checkout. If you’re into stock investments or bitcoin transactions, keep an eye on limited-time reward promotions tied to portfolio growth—these can include fee waivers or bonus stocks.

Critically, the rewards program isn’t just about spending. Cash App occasionally runs campaigns where users earn perks for sending money (P2P payments) or completing tutorials on features like money transfer safety. This educational angle makes it more than a transactional tool—it’s a gateway to smarter financial services usage. Compared to Wells Fargo’s rigid point systems or PayPal’s merchant-specific deals, Cash App’s dynamic rewards adapt to how you actually use money daily.

One downside? Rewards are often location-based, so urban users might see more offers than rural ones. Also, while peer-to-peer payments qualify for some bonuses, larger money transfers typically don’t earn rewards—something Zelle users might find familiar. Still, for frequent spenders and savers, stacking Boosts with direct deposit perks can lead to significant savings over time. Just remember: Always read the fine print, as terms change frequently (especially in 2025’s competitive fintech landscape).

Professional illustration about Dave

Cash App Tax Features

Cash App Tax Features

Cash App has evolved into more than just a peer-to-peer payment platform—its tax features now offer a streamlined way to manage your financial obligations. Unlike traditional tax software, Cash App Tax (formerly Credit Karma Tax) is completely free, whether you’re filing a simple 1040 or itemizing deductions. The integration with Cash App’s ecosystem—including direct deposit, debit card transactions, and even bitcoin trading—means users can easily import income and expense data. For freelancers or gig workers who rely on Square Point of Sale or Square Cash, this seamless connection eliminates manual entry errors.

One standout feature is its support for cryptocurrency trading tax reporting. If you’ve bought or sold Bitcoin through Cash App Investing LLC, the platform automatically generates IRS Form 8949, detailing capital gains or losses. This is a game-changer compared to manually tracking trades on exchanges like Venmo or PayPal, which lack built-in tax tools. Cash App Tax also handles stock investments, pulling data from brokerages to simplify Schedule D filings.

Security is another priority. With fraud prevention measures like multi-factor authentication and fraud monitoring, your sensitive tax info stays protected—a critical advantage over paper filings or less secure competitors like Zelle or Google Pay. Plus, for those with mobile banking accounts (e.g., Wells Fargo Bank, N.A. or Sutton Bank), Cash App Tax can import interest statements, saving time during tax season.

The user experience is refreshingly intuitive. Imagine you’re a small business owner using Block, Inc. tools: Cash App Tax can categorize expenses from your Square Point of Sale transactions, making it easier to claim deductions. Or, if you’ve received payments via peer-to-peer transactions, the platform flags potential taxable income. Even Dave users—who rely on cash advances—will appreciate the clarity around reporting requirements.

For freelancers, the ability to upload 1099-NEC or 1099-K forms directly (common with platforms like Venmo) ensures accuracy. And if you’ve ever struggled with state filings, Cash App Tax covers all 50 states—no upsells. While Apple Pay and Wells Fargo focus primarily on payments, Cash App’s tax features bridge the gap between everyday money transfer and long-term financial planning.

Bottom line: Whether you’re a crypto trader, freelancer, or just someone tired of paying for tax software, Cash App Tax demystifies the process. Its integration with financial services across the Cash App ecosystem—plus robust security—makes it a standout choice for 2025.